“In light of the significant financial challenges the MBTA is currently facing, specifically its tremendous debt burden, the precipitous decline in the receipt of projected and dedicated revenues since the inception of Forward Funding, and perhaps most importantly the inability to finance billions of dollars worth of critical state of good repair projects, the MBTA’s financial condition is perhaps not sustainable at current levels of operating and capital commitments.

-MBTA Capital Investment Program FY13 – FY17

The Massachusetts Bay Transit Authority (MBTA)’s rampant financial woes are finally a priority for the Massachusetts State Legislature. After a decade of high borrowing and low acquisitions, the cash-strapped Department of Transportation (MassDOT) is now almost unable to maintain or improve the infrastructure it has in place. At the end of the Massachusetts General Court’s last session, transportation employees and state legislators said that when it comes to future transportation reform, “everything is on the table.” In January, Governor Deval Patrick obliged them by proposing $13 billion in transportation investments over the next 10 years outlined in MassDOT’s The Way Forward: A 21st Century Transportation Plan, which would be paid for by new taxes. In the spirit of “everything on the table,” Governor Patrick suggested raising the gas, state income, and payroll taxes, creating a miles-traveled tax, and imposing new vehicle registration fees.

The way that MassDOT is funded needs reform because, as the MBTA acknowledged, it is not sustainable. Last year the MBTA asked the Massachusetts legislature to help fill a $161 million budget shortfall to in order to continue operations. A combination of service cuts, fare increases, and a one time transfer of surplus snow removal funds closed the financial gap for that year. The MBTA was able to dodge fiscal ruin last year, but new, dedicated revenue streams are necessary for the long-term viability of public transportation in Boston. Without reform, the MBTA will continue running deficits, largely due to its $5.2 billion debt and aging infrastructure. The Massachusetts legislature is ready to act on transportation funding, but it will have to reconcile its differences with the Governor’s proposal.

The MBTA’s primary trouble is a lack of revenue. In 2000, the MBTA received forward funding, meaning that the agency would receive a revenue stream from the Commonwealth to help cover expenses. The revenue came in the form of 16 percent of the state’s 6.25 percent sales tax.

“In short, the plan was doomed from the beginning,” said former Massachusetts Governor Michael Dukakis in an interview with the Review. “There was nothing wrong with the idea of forward funding, but nobody who knew anything about the subject thought that a penny on the sales tax could possibly pay for a chunk of the T’s operating expenses, its capital costs and additional costs loaded on the system to pay for the Big Dig.”

The projected revenue from the sales tax failed to meet expectations, which then required borrowing and loans for all expenses. The MBTA did not react quickly enough, and instead expanded service and raised fares too slowly over the past decade.

The MBTA is a quasi-public agency within the MassDOT, an executive branch public agency. This means that it is funded, to some extent, with state dollars, but is not accountable to a single elected official. The MBTA is headed by Dr. Beverly Scott, who reports to the MassDOT Board of Directors. MassDOT, although it has some governing functions over MBTA, has its own budget woes to reform this session. The Department habitually borrows money in order to fund operational costs: personnel, rent, and utilities. Money was even borrowed to pay the people who cut the grass next to the highway. For every dollar borrowed, MassDOT has to pay back $1.76. This practice does not make sense considering taxes are supposed to pay for the public agency’s basic costs.

The money required for building new infrastructure also falls upon MBTA and MassDOT. For a new track to extend the Green Line, MBTA borrows and issues bonds to pay for such a project. This typical business procedure is out of hand at the MBTA, because the agency is in charge of paying back the creditors. Prior to forward funding, the Commonwealth picked up 90 percent of capital costs. Without such support, the agency is saddled with so much debt that it has trouble paying to keep existing infrastructure in good repair.

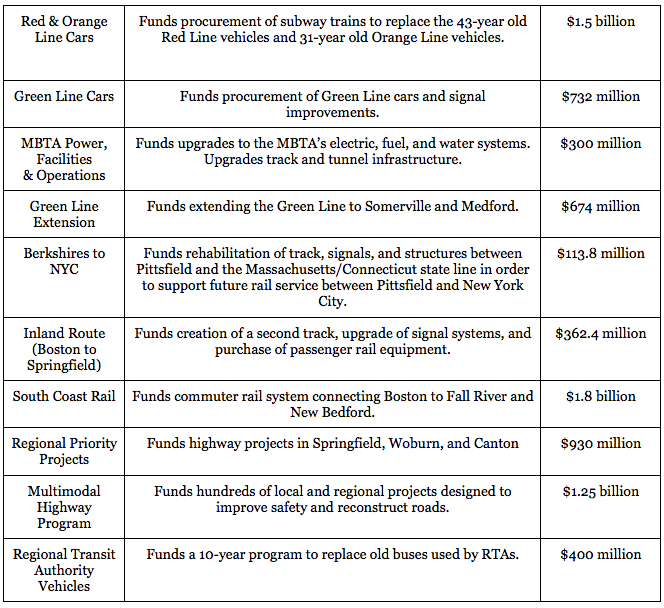

The Way Forward asks for $674 million to cover the costs of the Green Line extension, which will slightly reduce the MBTA’s debt burden. It also asks for over $2 billion in subway car replacements, which eliminates some of the increasing maintenance costs on old trains. Despite the growing debt, MBTA expanded service and raised fares too slowly. This, coupled with the increased maintenance costs on aging transportation infrastructure, inflated expenses to the point where the MBTA ran a deficit.

It is clear that Massachusetts’ transportation is in danger because, once again, the MBTA needs to take measures to close a $120 million shortfall for the next fiscal year. The legislature realizes that increasing taxes is a tough and unpopular vote, but one that needs to happen to save transportation.

There are multiple tax plans on the table to help fund these financially hurt agencies. An increase in the gas tax is one of the most talked about proposals. The current gas tax is antiquated, and due to inflation, the purchasing power of the 21 cents per gallon tax is now 12 cents. The last increase in the gas tax occurred in 1991, and since then, there have been only a couple proposals to raise it. In 2009, Governor Patrick recommended increasing the tax by 80 percent, but this was met with strong opposition from both parties. House Speaker Robert DeLeo opposed Governor Patrick’s previous gas tax proposals, but with a comprehensive reform package in place, this might change. Representatives Thomas Conroy and Byron Rushing proposed their own gas tax increase bills in 2009 and 2011. These bills were sent to study from committee, guaranteeing they would not be debated or voted on. Implementing a gas tax could be done by increasing the tax by a few cents each year until it reached a certain level, or the gas tax could be tied to inflation so that the tax periodically increases at a natural rate.

This legislative session, DeLeo may once again contest a Patrick proposal. The Speaker said on March 7th that he would back a smaller transportation plan focused on the MBTA and Regional Transit Authorities (RTAs). He expressed interest in new revenue earmarked for transportation, but is not necessarily on board with Governor Patrick’s $13 billion plan. Raising billions in taxes is crucial to the long-term survival of public transportation, but it is a plan that will need to be sold to the citizens of Massachusetts. Legislators recognize that there should be more funding for transportation, but their constituents have many concerns that need to be addressed. The Way Forward Plan recommends more money for new subway cars than it does for bridge building and maintenance. People within the MBTA service district stand to gain the most by replacing 30 and 40 year-old subway cars. Over the next ten years, the proposed transportation plan would only allocate $400 million for Regional Transit Authorities, $1 billion in new municipal road management systems, and over $1 billion for bridge maintenance.

A proposal of this magnitude is necessary, although it will most likely be greatly altered by the time Governor Patrick signs the bill. A popular phrase in state government is, “the Governor proposes, and the Legislature disposes,” and this adage is very relevant to the Governor’s plan. If the Governor’s proposal is to succeed, legislators need to be able to bring transportation funding back to their communities. Metropolitan Boston stands to benefit from a more reliable public transportation system, and legislators from the rest of the state want a cut of the transportation funds. Negotiations this session will be a balancing act of bailing out the MBTA while also appeasing the western two-thirds of the Commonwealth. The Governor’s proposal alludes to a future potential passenger rail connection from Springfield and Pittsfield to New York City.

21st Century Transportation Highlights

The Way Forward is an ambitious list of tasks that will ultimately be dissected by the legislature. Over $1 billion is recommended to work on hundreds of local projects, which would be a boon to municipalities, but it is uncertain which projects have priority. The projects in the The Way Forward attempt to strike a balance by funding projects around the Commonwealth. In the plan, there is no explicit funding listed for Massachusetts’s major “gateway” cities such as Lowell, Worcester, and Fitchburg. These important urban areas need transportation funding to modernize streets and town centers. This plan takes great steps in fixing the broken MBTA; what is questionable is whether or not the legislature can agree to fund such an ambitious plan.

The Massachusetts legislature has a tall task ahead of them. The legislature is dedicated to fixing transportation in Massachusetts, but legislators need to find a compromise. How much will taxes be raised? Which projects will be funded first? Which district will benefit the most? These issues will be reconciled somehow in the House on April 22nd, and in the Senate on May 20th. The House Ways and Means budget proposal will be released on April 10th, which will outline the legislature’s counterproposal for the budget. MassDOT and MBTA need new revenue, and these agencies should receive funding. At the same time, roads and cities outside of Boston need modern infrastructure. Every town from the Pittsfield to Provincetown stands to benefit from transportation funding, but it is up to the legislature to ultimately decide the allocation of funds.

Eric Massak

Political Science ’14

The Way Forward http://www.massdot.state.ma.us/Portals/0/docs/infoCenter/docs_materials/TheWayForward_Jan13.pdf

Quasi-public definitions: http://www.mass.gov/portal/government-taxes/branches-agencies/independent-quasis/