The Bermuda Triangle is one of our society’s most well-known ghost stories, home to mysteries, misunderstandings, and misinformation. Time and again, conspiracy theorists attempt to paint the disappearances surrounding the infamous site as a supernatural hotspot, but with little evidence to prove their stories.

In reality, accidents happen within the Bermuda Triangle at the same frequency as the rest of the Atlantic Ocean, suggesting that instead of a paranormal phenomenon, the area is merely a natural part of our oceanic ecosystem.

Instead of conspiracy theorists, politicians take the stage to create uneasiness and uncertainty around inflation. Because inflation is constantly manipulated and villainized to invoke a sense of economic fear, the average consumer does not see it for what it really is: just another part of the economy, like how the Bermuda Triangle is just another part of the ocean.

The “Bermuda Triangle Effect” manifests itself in the way we mindlessly consume modern day media and let it shape how we interpret concepts we don’t understand. By allowing conspiracy theorists and politicians to influence our perception of foreign ideas like the Bermuda Triangle and inflation, we risk becoming desensitized when they turn into a real issue. This year’s inflation crisis is unlike those of years past, proving to be disproportionately burdensome for our economy and especially for small businesses. But if we, as consumers, do not first understand how inflation works and what it means in a post-pandemic world, we cannot move forward and find long-term solutions to keep our financial health stable.

Inflation, Debunked

Inflation describes a general increase in prices for goods and services in an economy. It doesn’t raise prices itself, but is rather an indicator of how prices change over time. Although products become more expensive each year as a consequence of inflation, it is not a significant issue if maintained at a low, stable rate, and it can even be a positive indicator for a robust and active economy. While a positive inflation rate means that prices are rising, your wages should rise proportionately and your real income should stay the same.

In popular culture, people often cite inflation as why we can’t just “print more money,” but we rarely explain this conundrum to the average consumer. If the government pushes more money into circulation, consumer spending will increase rapidly, and inflation will increase to higher levels than we can sustain. This trend pushes the risk of hyperinflation: unrestrained price increases with inflation rates beyond 50 percent, which cause essential goods, like food and water, to become exorbitantly expensive and inaccessible. For perspective, a normal inflation rate in the United States is approximately 2 percent.

On the other hand, deflation, a general decrease in prices, is a worse sign for our economy. If consumer demands fall significantly, leading to less money being spent and circulated, the level of prices will fall and lead to an economic downturn. Inflation may have consequences, but it can prove to be more beneficial for consumers in the long run in smaller increments.

The inflation rate as of December 2021 is a different story altogether. At 7 percent, it has soared past what we have experienced over the last few years. While not yet considered hyper-inflationary, it has reached levels we haven’t seen since the end of the Great Inflation, which lasted from 1965 to 1982. However, in 1982, the inflation rate cooled to 7 percent, a sign that inflation had become tempered. But, in 2022, it’s a sign that inflation is beginning to unleash itself.

As indicated by the term “Bidenflation,” journalists and politicians have attributed the recent crisis to inefficiencies under the Biden Administration. Others have speculated that corporations have intentionally exacerbated the recent rise in prices. Biden himself claims that large corporations have raised their prices to maximize profits while using inflation as a scapegoat, perpetuating the wage-price spiral. In this cycle, businesses raise prices to earn more money and labor unions use the extra profit as a bargaining chip for workers to earn higher wages. In turn, this causes consumer spending to rise and motivates businesses to raise their prices again. Another excuse for this year’s inflation rate is all too familiar: COVID-19. Now that stores are reopening, consumer spending is rising faster than we can currently handle.

With multiple theories for the recent crisis, too much emphasis has been placed on inflation rather than on what steps we need to take to stabilize our economy. Here, the “Bermuda Triangle Effect” has taken action: mistakenly fixated on the big, bad inflation rate, consumer confidence in the economy drops, perpetuating further long-term damage.

The Problem for Small Businesses

For small businesses across the US, raising prices to match inflation can decrease consumer spending, which is detrimental to maintaining enough profit to stay afloat. In periods of high inflation rates, more local businesses are forced to close down, which benefits larger companies who can, more often than not, afford to take these hits.

If small businesses don’t raise their prices, or only raise their prices by a small amount, it is likely that consumers will still purchase their products at roughly the same rate, holding all other factors constant, and the end-of-year profits will appear similar to years past. However, the value of the profit itself has decreased because inflation is also an indication of how much each dollar in circulation is worth. If your income doesn’t increase to match inflation each year, you’re actually losing value through your purchasing power, which is what you can do with the money that you have. This creates a catch-22 for small businesses: if you raise your prices, you lose out on sales, and if you keep your prices the same, you lose out on income.

This is a losing battle for most small businesses, but it especially hurts independent, family-owned mom-and-pop shops that face the additional challenges of technology issues, generational barriers, resource availability, and lack of market power. Moreover, mom-and-pop shops started and continued by older citizens and immigrants more commonly struggle with rapid technology developments in the workplace.

In comparison, larger businesses and corporations have unlimited resources to anticipate changes, including a modernized employee base that can quickly adapt to new software, machines, and programs. In the modern workplace, having advanced technology can make it much easier to adjust prices as inflation rates rise. For instance, owners of local retail stores who lack such resources may have to change all their labels and prices by hand, a time-consuming and costly process.

Moreover, larger companies hold more shares in their respective industries relative to small businesses, giving them more power in setting market prices, forcing small businesses to take prices.

In the context of the “Bermuda Triangle Effect,” small businesses are like planes crashing into the Atlantic. Owners don’t know where to fly or how to stop the fall which feels almost inevitable.

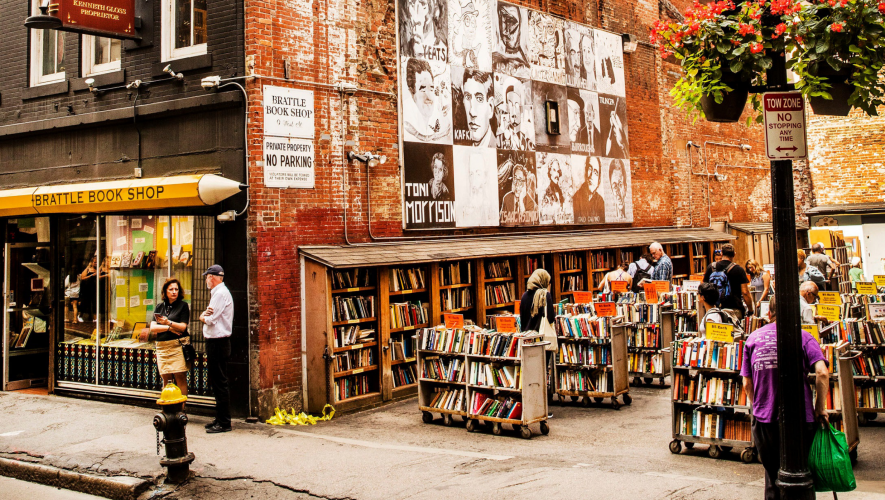

Small businesses in urban and commercialized areas like Boston particularly struggle to operate against large corporations.

For Brattle Book Shop, a bookstore located in Downtown Boston, inflation means rising costs without raising prices. In other words, prioritizing consumer needs has forced them to sacrifice economic success. In direct correspondence with the author, a Brattle Book employee states: “We have not raised any of our prices. We’ve always tried to keep our prices as low as possible so that our customers can get a good value for their purchases. The rising prices of supplies is what has affected our business the most. I don’t think these will go down.”

Brattle Book Shop’s decision to maintain its prices is an apt example of how small businesses tend to place customers first at their own expense. However, their struggles are not unique and stress how critical community support is in helping small businesses survive.

What Next?

On a national level, the Federal Reserve (the “Fed”) sets interest rates that counteract the negative effects of inflation. When inflation is excessively high—as it is now—the Fed raises interest rates to encourage saving over spending, thereby controlling consumer spending without discouraging economic growth. The Fed is likely to hike interest rates around four times this year; in May, they raised rates by half a point, one of the largest increases in two decades.

Local and state governments can better provide support and protection for small businesses. In Boston, Mayor Wu is working toward a system where monetary relief is allocated to small businesses to manage the pandemic’s damage. She is also planning on implementing protections against gentrification (which often leads to store closures for smaller businesses), lighter barriers towards licensing and operating procedures, and more community building programs.

On the Massachusetts state level, Governor Baker has announced an additional $30 million in support of small businesses. However, these protections do not target inflationary issues themselves and instead opt to provide local shops with the resources they need to stay afloat, despite their preexisting setbacks.

The best course of action for the average consumer to help with the current inflation crisis is to invest carefully and rationally. Intentionally decreasing your spending out of fear will only contribute to a stagnant economy and will do nothing to support the small businesses and mom-and-pop shops that inflation impacts the most. Instead, consider supporting more local businesses in your area.

Issues like inflation are unavoidable and shipwrecks happen in the ocean all the time. This is what the “Bermuda Triangle Effect” has wrong: you shouldn’t let your fear of systemic challenges prevent you from keeping a clear mind and pushing forward.