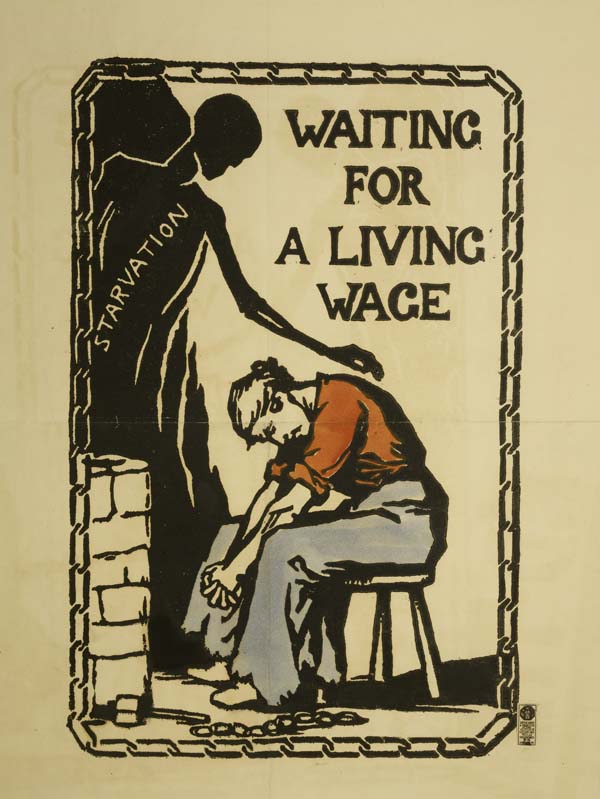

Congressional Democrats have renewed the fight to give working Americans a raise. In January, they proposed the Raise the Wage Act, which would gradually increase the federal minimum wage from $7.25 to $15 an hour by 2024. The bill is already supported by 181 Democratic sponsors in House and 31 in the Senate.[1] The proposal comes at a time when many states and cities have not only set their minimum wage above the federal limit, but are pushing for further increases.[2] Raising the minimum wage is also popular with the general public. According to a poll from Pew Research Center, 58% of Americans support increasing the minimum wage to $15 an hour.[3] While popular opinion alone should make Congress consider raising the minimum wage, Congress should also consider the minimum wage’s role in combating poverty and ensuring workers a decent standard of living.

The real value of the minimum wage has been in decline since 1968, when it peaked at $1.60 (equivalent to $9.08 in today’s dollars).[4] This depreciation means that minimum wage workers have been experiencing declining quality of life over the past fifty years. The fall in workers’ real earnings has also come during a period of rising worker productivity across occupations.[5] While minimum wage workers are producing more, they are receiving less.

The federal minimum wage we recommend is $12.87 in 2018 dollars. This figure was calculated by using MIT’s Living Wage Calculator to find the living wage of the nation’s cheapest city to live in: McAllen, Texas.[6] We incorporated a multiplier that accounts for vacation time, enables savings, and assumed a work year of 40 hours per week for 50 weeks, allowing workers to take up to two weeks off per year for personal or vacation days. This wage would also allow workers to save up to 20% of their income, helping them to avoid living paycheck to paycheck. These savings can act as a buffer for emergencies, such as unemployment, health care related expenses, and parental leave, and allow people to save up for large purchases or investments. Basing the minimum wage on the cheapest city in the U.S. would also help prevent businesses in cities with low costs of living from being burdened by an unnecessarily high minimum wage. To avoid erosion of its purchasing power through inflation, the minimum wage should be linked to the consumer price index (CPI), the official inflation level, as 17 states have already done.[7]

The definition of workers eligible for minimum wage should also be expanded. Current federal regulations regarding minimum wage were established under the Fair Labor Standards Act (FLSA) of 1938.[8] Such regulations, however, were originally defined to exclude workers of color by purposely excluding occupations in which they were disproportionately employed, such as farm and domestic work.[9] The exclusion of farm workers is inherently racist and perpetuates racial inequality.[10] This is also true for tipped workers. Research has shown that the practice of tipping is often discriminatory, with white workers receiving more tips than black workers for the same work.[11] Forcing people to rely on tips to make up for a lower minimum wage creates unstable income flows, making it harder for people to budget or manage financial emergencies.[12]

In addition to raising the minimum wage, there have also been multiple anti-poverty proposals put forward by 2020 Democratic presidential candidates. These include Senator Kamala Harris’s Livable Incomes for Families Today (LIFT) the Middle Class Act and Senator Cory Booker’s Housing, Opportunity, Mobility, and Equity (HOME) Act. These bills would supplement wages through the tax code and subsidize renters respectively, and both are designed to reduce poverty in the U.S.[13] An increased minimum wage combined with any of the proposed legislation would likely lead to a dramatic increase in workers’ living standards.

So what is a living wage? While many policymakers usually compare income to the federal poverty threshold to determine an individual’s standard of life, using that measurement to determine poverty is flawed. The official poverty measure is defined as “three times the ‘subsistence food budget’” for a given family size, which was first calculated in 1963 using 1955 data. It has been adjusted only to account for inflation.[14] Clearly, it’s about time this was changed, as food costs have risen substantially, not to mention rising rent, health care, and education costs as well. The minimum wage should be based off of a living wage, rather than the poverty line, to take into account not only monetary costs, but also costs that affect people’s work and life balance.[15]

Tying the minimum wage to a dynamic living wage calculation would drastically increase the minimum wage by 78%, but it doesn’t quite yield the $15/hour figure supported by many progressives. There are two main reasons why. First, the federal minimum wage should exist as part of a system where state and local governments take on the primary responsibility for looking after their own minimum wages, with the federal minimum existing as a backstop in the event of political neglect or gridlock on the minimum wage. The role of the federal minimum wage should not be to prescribe a one-size-fits-all policy, but to set a foundation so that each state and locality can set an appropriate minimum wage policy for their region while still ensuring livable earnings for workers. Localizing the minimum wage would not only cause state and local governments to be more accountable to their constituents on this issue, but they can also pass the necessary legislation more swiftly than the federal government since they are smaller with fewer stakeholders. Tying the federal minimum to inflation and other apolitical economic indicators would effectively alleviate Congress of the responsibility to continually raise the minimum wage, allowing it to occur automatically. As Congress would become more detached from setting the minimum wage, states and local governments would necessarily and preferably become the critical political pathway for minimum wage increases.

While ideally, states and local governments should take the lead in setting the minimum wage, the federal minimum wage still maintains an important role. In addition to serving as a backstop, the federal minimum would also serve as a reference point for policymakers and advocates when determining regional minimum wages. The second reason to set the minimum wage at our suggested level rather than $15 is to contextualize the role that a federal minimum wage should play in combating poverty and ensuring workers a decent standard of living. A simple policy like a minimum wage should not be seen as a stand-alone fix for issues such as housing, food insecurity, wealth inequality, healthcare, childcare, and other economic challenges. Rather, the minimum wage should be accompanied by more targeted, nuanced programs meant to address these issues, such as single payer healthcare and subsidized parental leave. Despite being the largest proposed minimum wage increase, the Democratic proposal fails to change the paradigm through which we view the minimum wage and sticks to the archaic practice of Congress selecting a new, seemingly arbitrary number every few years.

A popular argument against raising the minimum wage is that it would translate to higher unemployment by creating greater costs for businesses. But according to the evidence, that’s not necessarily true. The federal minimum wage, adjusted for 2018 dollars, peaked in 1968 at $9.08, yet the unemployment rate was at 3.6%, a historic low.[16][17] Several case studies have failed to find any association between the minimum wage and unemployment. In one famous 1994 study, economists David Card and Alan B. Krueger reviewed the effects of a higher minimum wage by comparing 410 nearby fast-food restaurants in New Jersey and Pennsylvania before and after New Jersey’s minimum wage increase. This increase in the minimum wage across similar areas allowed Card and Krueger to observe what is known as a “natural experiment,” as it controls for other factors that can affect employment. Finding that an increase in New Jersey’s minimum wage had been associated with stronger employment growth, contrary to the theoretical literature, they concluded that their “empirical findings challenge the prediction that a rise in the minimum reduces employment.”[18] More recently, Seattle’s minimum wage increase to $15 per hour “is within the range of increases that other research has found to have had little to no effect on employment,” as economists Ben Zipperer and John Schmitt have noted.[19]

While other studies have found raising the minimum wage to be associated with greater unemployment, economists David Neumark and William Wascher have reviewed a multitude of papers to gauge the overall conclusion of the literature. They found that there is “a lack of consensus about the overall effects on low-wage employment of an increase in the minimum wage,” although “a sizable majority of the studies surveyed… give a relatively consistent (although not always statistically significant) indication of negative employment effects of minimum wages.”[20] Ultimately, there is no definitive evidence that a modest increase in the minimum wage would significantly increase unemployment.[21]

There are a few explanations for why the real world doesn’t work the way the theory predicts. While it’s argued that a higher minimum wage would mean layoffs, with businesses replacing workers with technology, labor-saving technologies may not be affordable or realistic. Smaller companies in particular may not be able to afford the high start-up costs of technologies to replace workers. Furthermore, there are many jobs that still require at least some people working along with the technologies. Certain companies cannot lay off workers even if the minimum wage rises. For example, even if a restaurant becomes mostly automated, such as Boston’s Spyce Kitchen, it is still necessary to have at least one worker on-hand to provide customer assistance.[22]

There are also concerns that a minimum wage increase could lead to cuts in hours or even businesses shutting down completely. Our proposed federal minimum wage accounts for a workweek of 40 hours per week for 50 weeks. For workers who are unable to work the full 40 hours per week, other government programs, such as wage supplements, are needed. Concerns about businesses shutting down completely come predominantly from smaller businesses, who may or may not be exempt from the federal minimum wage depending on their size and annual sales.

Most importantly, increasing the minimum wage would increase the purchasing power of the working poor. By raising the minimum wage, people will be able to afford to spend more and thereby stimulate the businesses that are facing higher costs. An increase in consumer spending could boost the economy in the short-run, leading to faster job growth.[23] An increase in the minimum wage could also boost worker productivity, as employee morale and work ethic increase when employees believe that they are being paid a wage that makes poor performance costlier, what is known in economics literature as the “efficiency wage hypothesis.”[24] Moreover, if wages increase, labor participation may increase as well, as the opportunity cost of being out of the labor force naturally increases.

Even if the minimum wage does increase unemployment, that cost is more than offset by the benefits of those still employed after the wage increase. According to a 2014 study by the Congressional Budget Office, if the minimum wage were to increase to $10.10 per hour, total employment was predicted to decrease by about 500,000 workers.[25] While that may sound like a lot, in an economy where about twenty million people are laid off annually, the effects of a $10.10 minimum wage on total employment would be negligible.[26] And this would be more than offset by the 24.5 million people who would benefit from higher wages, serving as part of the remedy for widening wage inequality.[27][28]

Ultimately, the benefits to raising minimum wage outweigh the costs. In fact, seven Noble-prize winning economists agree that the minimum wage should be raised to at least $10.10.[29] An increased minimum wage is crucial to improving the lives of American workers, with the ideal minimum wage being a living wage linked to inflation and one that would give subnational governments a greater role in setting region-specific minimum wages. There are certainly those who will argue that the number we put forward is lacking and fails to address the myriad of economic woes. However, it’s important to keep in mind that the minimum wage is only one policy tool for addressing systemic poverty and wealth inequality. A more robust scheme to address these issues will require more than just an appropriate minimum wage. Until that happens, all we’re really doing is passing the buck to the next generation.

[1] Pramuk, Jacob. “Democrats introduce bill to hike federal minimum wage to $15 per hour.” CNBC. January 16, 2019. https://www.cnbc.com/2019/01/16/house-democrats-introduce-bill-to-hike-minimum-wage-to-15-per-hour.html.

[2] Herron, Janna. “From California to New York, states are raising minimum wages in 2019 for 17 million workers.” USA Today. December 27, 2018. https://www.usatoday.com/story/money/2018/12/27/minimum-wage-2019-which-states-increasing-next-year/2377035002/.

[3] “Would you favor or oppose an increase in the federal minimum wage from $7.25 an hour to $15 an hour?” Pew Research Center for the People & the Press Poll Database. Last modified August 2016. http://www.people-press.org/question-search/?qid=1884112&pid=51&ccid=50#top.

[4] DeSilver, Drew. “5 facts about the minimum wage.” Pew Research Center. January 04, 2017. http://www.pewresearch.org/fact-tank/2017/01/04/5-facts-about-the-minimum-wage/.

[5] The New York Times Editorial Board. “The Case for a Higher Minimum Wage.” The New York Times. February 08, 2014. https://www.nytimes.com/2014/02/09/opinion/sunday/the-case-for-a-higher-minimum-wage.html.

[6] Carter, Shawn M. “These are the top 5 most affordable US cities.” CNBC. January 18, 2018. https://www.cnbc.com/2018/01/25/the-top-5-cheapest-cities-in-america.html.

[7] Brainerd, Jackson. “State Minimum Wages.” National Conference of State Legislatures. 2018. Accessed March 15, 2019. www.ncsl.org/research/labor-and-employment/state-minimum-wage-chart.aspx.

[8] U.S. Department of Labor. “Handy Reference Guide to the Fair Labor Standards Act.” U.S. Department of Labor. Last modified September 2016. https://www.dol.gov/whd/regs/compliance/hrg.htm.

[9] Perea, Juan F. “The Echoes of Slavery: Recognizing the Racist Origins of the Agricultural and Domestic Worker Exclusion from the National Labor Relations Act.” Ohio State Law Journal 72. no. 1 (2011): 95-138.

[10] Liu, Yvonne Yen. “Food Workers—Wages and Race.” Race, Poverty & the Environment. 18, no. 1 (2011): 10-12. http://www.jstor.org.ezproxy.neu.edu/stable/41555301.

[11] Lynn, Michael, Michael Sturman, Christie Ganley, Elizabeth Adams, Mathew Douglas, and Jessica McNeil. “Consumer Racial Discrimination in Tipping: A Replication and Extension.” Journal of Applied Social Psychology 38, no. 4 (March 19, 2008.): 1045-1060.

[12] Gould, Elise, and David Cooper. “Seven facts about tipped workers and the tipped minimum wage.” Economic Policy Institute. 2018. Accessed March 13, 2019. https://www.epi.org/blog/seven-facts-about-tipped-workers-and-the-tipped-minimum-wage/.

[13] Matthews, Dylan. “5 anti-poverty plans from 2020 Democratic presidential contenders, explained.” Vox. January 30, 2019. https://www.vox.com/future-perfect/2019/1/30/18183769/democrat-poverty-plans-2020-presidential-kamala-harris-booker-gillibrand.

[14] Matthews, Dylan. “The official poverty measure is garbage. The census has found a better way.” Vox, September 12, 2017. https://www.vox.com/2015/9/16/9337041/supplemental-poverty-measure.

[15] Glasmeier, Amy K. “LIVING WAGE CALCULATOR: User’s Guide / Technical Notes.” Massachusetts Institute of Technology. 2017. Accessed December 02, 2018. http://livingwage.mit.edu/resources/Living-Wage-User-Guide-and-Technical-Notes-2017.pdf.

[16] DeSilver, Drew. “5 facts about the minimum wage.”

[17] Bureau of Labor Statistics. “Labor Force Statistics from the Current Population Survey.” U.S. Department of Labor. Accessed Feb 11, 2019, https://data.bls.gov/timeseries/LNU04000000?periods=Annual+Data&periods_option=specific_periods&years_option=all_years.

[18] Card, David, and Alan B. Krueger. “Minimum Wages and Employment: A Case Study of the Fast Food Industry in New Jersey and Pennsylvania.” American Economic Review 84, no. 4 (September 1994): 772-793.

[19] Zipperer, Ben, and John Schmitt. “The “high road” Seattle labor market and the effects of the minimum wage increase.” Economic Policy Institute. 2017. Accessed March 13, 2019. https://www.epi.org/publication/the-high-road-seattle-labor-market-and-the-effects-of-the-minimum-wage-increase-data-limitations-and-methodological-problems-bias-new-analysis-of-seattles-minimum-wage-incr/.

[20] Neumark, David, and William Wascher. “MINIMUM WAGES AND EMPLOYMENT: A REVIEW OF EVIDENCE FROM THE NEW MINIMUM WAGE RESEARCH.” Foundations and Trends in Microeconomics 3, no. 1 + 2 (November 2006): 1-182.

[21] Doucouliagos, Hristos, and T.D. Standley. “Publication Selection Bias in Minimum‐Wage Research? A Meta‐Regression Analysis.” British Journal of Industrial Relations 47, no. 2 (June 2009): 406-428.

[22] Kim, Irene, and Exa Zim. “Four MIT graduates created a restaurant with a robotic kitchen that cooks your food in three minutes or less.” Business Insider. May 28, 2018. https://www.businessinsider.com/spyce-restaurant-uses-robotic-kitchen-cook-food-three-minutes-fast-casual-boston-2018-5.

[23] Cooper, David, and Douglas Hall. “How raising the federal minimum wage would help working families and give the economy a boost.” Economic Policy Institute. 2012. Accessed March 13, 2019. https://www.epi.org/publication/ib341-raising-federal-minimum-wage/.

[24] Akerloft, George A., and Janet L. Yellen. “THE FAIR WAGE-EFFORT HYPOTHESIS AND UNEMPLOYMENT*.” The Quarterly Journal of Economics 105, no. 2 (May 1990.): 255-283.

[25] Congressional Budget Office. “The Effects of a Minimum-Wage Increase on Employment and Family Income.” Congressional Budget Office. 2014. Accessed March 14, 2019. https://www.cbo.gov/publication/44995.

[26] “Layoffs and Discharges: Total Nonfarm.” U.S. Bureau of Labor Statistics. FRED (Federal Reserve Bank of St. Louis). Accessed March 05, 2019. https://fred.stlouisfed.org/series/JTSLDL.

[27] Bernstein, Jared. “The Minimum Wage Increase and the CBO’s Job Loss Estimate.” On The Economy: Jared Bernstein Blog. 2014. Accessed March 13, 2019.

[28] DePillis, Lydia. “The case for raising the minimum wage keeps getting stronger.” CNN Business. April 27, 2018. https://money.cnn.com/2018/04/27/news/economy/minimum-wage-increase/index.html.

[29] Coy, Peter. “Seven Nobel Economists Endorse a $10.10 Minimum Wage.” Bloomberg Businessweek. January 14, 2014. https://www.bloomberg.com/news/articles/2014-01-14/seven-nobel-economists-endorse-a-10-dot-10-minimum-wage.